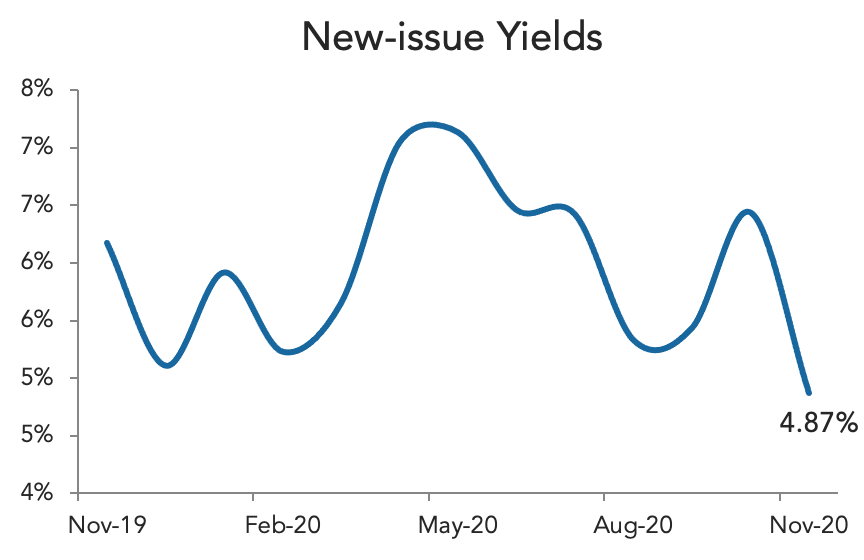

As long as the Fed cannot control inflation, leveraged companies will find it harder and harder to pay their existing debt, and if they can get lenders to underwrite them more loans, the rate which companies will have to pay will be higher. The stocks that will be particularly hurt are those of companies that are very leveraged, what bank regulators typically describe as having levels of debt six time more than their Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA). Sharp Drop in MM LBO Volume and Deals: LBO transactions were virtually non-existent in 4Q22, adding only 1.4 billion in new issuances across 12 deals, up slightly from 3Q22 and but down 68 yoy.

#Levfin insights plus

treasuries and investment grade bonds as safe havens. Through the acquisition of CreditSights, Fitch Group will complement its portfolio by adding a leading provider of relative value credit research to a suite of products that includes legal analyses and fixed-income news offered by Fitch Solutions Leveraged Finance Intelligence through its Covenant Review, Capital Structure, LevFin Insights and. MM issuance data from LevFin Insights include all syndicated deals with less than 50 million in EBITDA plus all club/direct lending deals. As a result, we have revised our 2023 GDP forecast from a fall of 3.5 to a contraction of 1.3. For the foreseeable future, unfortunately, this is a bad spiral, and I expect significant periods of stock market volatility.Īs long as the Federal Reserve cannot control inflation, I expect that investors will continue to sell stocks periodically, and will rush to U.S. The Russian economy contracted by 1.9 year-on-year (y-o-y) in Q123 which was less than the 2.1 fall Bloomberg consensus and an improvement compared to the 2.7 decline recorded in Q422. Additionally, I anticipate that companies will start to reduce the dividends that they pay investors. Explore our extensive archive, company profiles, and transaction database to find opportunities and drive returns. Gain real-time intelligence on debt transactions.

In those cases, unsecured creditors on average are worse off, according to a study published this week. Deep, unique insight into individual deals and current trends, including colour from key senior sources.

Faced with higher costs of borrowing, companies then continue to raise prices for consumers. So-called independent directors with strong ties to distressed debtors and private equity sponsors are being appointed with increasing frequency in large chapter 11 cases.

Inflationary pressure is not only hurting consumers, but also continues to push companies’ cost of borrowing up. LevFin Insights’ market coverage runs the gamut from individual deal reporting, to current market trends.

#Levfin insights free

US Economic Outlook, 2020-2023 (Oct) The Conference Board LevFin Insights provides news and analysis covering the debt capital markets including leveraged loans, high yield, secondary trading, CLOs, middle market and BDCs. Is this you As a journalist, you can create a free Muck Rack account to customize your profile, list your contact preferences, and upload a portfolio of your best work.

0 kommentar(er)

0 kommentar(er)